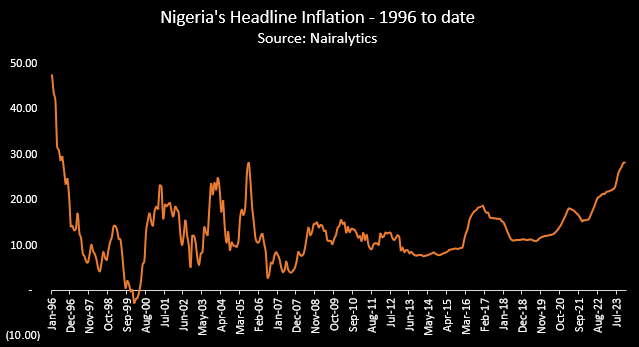

The National Bureau of Statistics (NBS) released Nigeria’s monthly Consumer Price Index (CPI) report for Nigeria last week Friday, revealing a headline inflation rate of 28.2% for November 2023.

This according to the Bureau, represents the eleventh consecutive month of increase so far in the year and the highest level since July 2005 (over 18 years).

Year-to-date, Nigeria’s inflation rate has increased by 7.21% points, the fastest pace recorded since the economic recession in 2016.

Further breakdown of the report showed that the surge was largely driven by the food prices, which have been negatively affected by insecurity in the food-producing regions, rising transport costs, and flooding, amongst other underlying factors.

While Nigeria has been grappling with a double-digit inflation rate over the last 7 years, the cannon that broke the horseback was the removal of the petrol subsidy in May 2023 by the new administration of President Tinubu saw the rate surge at unprecedented levels not seen in decades.

Currently, Nigeria is trailing its worst inflation level in over 18 years as of November 2023. However, a simple time series forecast shows that Nigeria’s inflation rate will rise to at least 28.28% in December, all things being equal. This would effectively bring Nigeria’s inflation to its worst level since 1996 (over 27 years).

Causes

According to the NBS, the major drivers of Nigeria’s inflation in November 2023 were food and beverages, road and air transport, pharmaceutical drugs, and accommodation amongst others.

- Specifically, food and non-alcoholic beverages contributed 14.61% to the headline inflation in the review month, followed by housing, water, electricity, gas and other fuel with 4.72%, while clothing and transport contributed 2.16% and 1.84% respectively.

- The double-whammy effect of petrol subsidy removal and the devaluation of the naira at the official market, which both saw petrol prices increase by over 221% and the exchange rate devalue by about 51% has impacted the prices of most goods and services in the country.

- Transport costs have tripled, food prices are at critical levels and highly volatile, cost of drugs has also surged following reports of GSK pulling out of Nigeria.

Detty December could worsen the rate

Despite the conservative forecast of 28.28% for the month of December, prices could be further inflated as a result of festivities in the country during this period.

- The month of December, which is generally characterised by a lot of food consumption, merriment, travel, and outdoor events could trigger demand-pull inflation.

- During the yuletide, many Nigerians in and outside the country travel to visit their families in the village and in the country, respectively, leading to increased demand for transportation services. Also, increased festivities could drive the price of groceries, and food items upward, which could see headline inflation surpass the projected 28.28%.

The possibility of petrol prices rising further to over N700 per litre could also worsen the current trend of inflation pressure. Recall that the World Bank had suggested that the government need to discontinue any form of petrol subsidy payments, which would translate to a payment of N750/litre for Nigerians.

The persistent cash scarcity in some regions of the country could also be a sticky area for inflation, as previous experience of cash draught followed with significant surge in prices.

Nigeria’s inflation is most likely to hit or surpass the 28.28% projection, resulting in its highest point in more than 27 years. However, the rate is expected to taper towards the second quarter of 2024 as the effect starts to set in.

The rising cost of goods and services in Nigeria amidst relatively fixed earnings, means more Nigerians are experiencing weakening purchasing power, pushing millions more Nigerians below the poverty line.

It is crucial for Nigerians to prioritize and tailor their expenses to meet their current earning capacity or seek to improve their income either by acquiring more relevant knowledge or diversifying.

Meanwhile, the CBN and the government need to come up with a cocktail of policies to tame this high trend of inflation that has resisted the effect of just interest rate hikes.