The federal government plans to provide subsidy to developers and operators of solar mini-grids in unserved and underserved areas in the country.

The subsidy will be provided through a World Bank approved loan of $750 million under the Distributed Access through Renewable Energy Scale-up (DARES) project.

This was disclosed in the financing agreement for the loan project seen by Nairametrics. The financing agreement for the loan was signed by the Minister of Finance, Wale Edun, on March 31, 2024, and World Bank’s Country Director for Nigeria, Shubham Chaudhuri, on February 19, 2024.

The loan project is fundamentally aimed at augmenting the supply of electricity to both households and micro, small, and medium-sized enterprises (MSMEs) through a surge in private sector-led distributed renewable energy initiatives.

- The document noted that the loan will be partly used to provide “Support to the development and operation of privately owned and operated solar hybrid mini grids in unserved and underserved areas through: 1.1. Minimum Subsidy Tender Carrying out of Minimum Subsidy Tender processes and provision of Minimum Capital Cost Subsidies to selected developers/operators of: (a) Isolated mini grids; (b) Interconnected mini grids; or (c) Solar rooftop solutions in Participating States.”

Performance-Based Grants

Asides from providing subsidy, the federal government plans to also provide performance-based grants.

- The document noted that there will be “Provision of Performance-Based Grants to eligible mini grid operators based on new customer connections for isolated mini grids and percentage of capital expenditures for interconnected mini grid projects.”

- The grant will also cover Standalone Solar (SAS) Systems for Households, MSMEs, and Agribusinesses. This grant will provide “Support to the expansion of SAS systems for households, MSMEs, and agribusinesses in rural areas through: 2.1. Performance Based Grants for Standalone Solar Provision of Performance Based Grants (“PBGs”) to eligible companies to rapidly deploy SAS solutions in rural and underserved areas, through supply and demand side support and based on independently verified outputs, and to support deployment of solar productive use of electricity (PUE) equipment to MSMEs, agribusinesses and commercial customers.”

- There will also be “Catalytic Grants Provision of Catalytic Grants, on a matching basis, to eligible SAS companies that target the poor, remote, or hardest to reach consumers in the country.”

About the financing

The loan from the World Bank is structured into three distinct segments, cumulatively forming the $750 million total financial package. This package is segmented into credits of $350 million, $250 million, and $150 million, each earmarked for different facets of the project and subject to currency conversions as necessary.

The primary implementers of this project are the Rural Electrification Agency (REA) and the Lagos State Electricity Board (LSEB), with significant support from the Federal Ministry of Power, the Nigerian Electricity Management Services Agency (NEMSA), the Federal Ministry of Environment, the Nigerian Electrification Regulatory Commission (NERC), and the Federal Ministry of Finance.

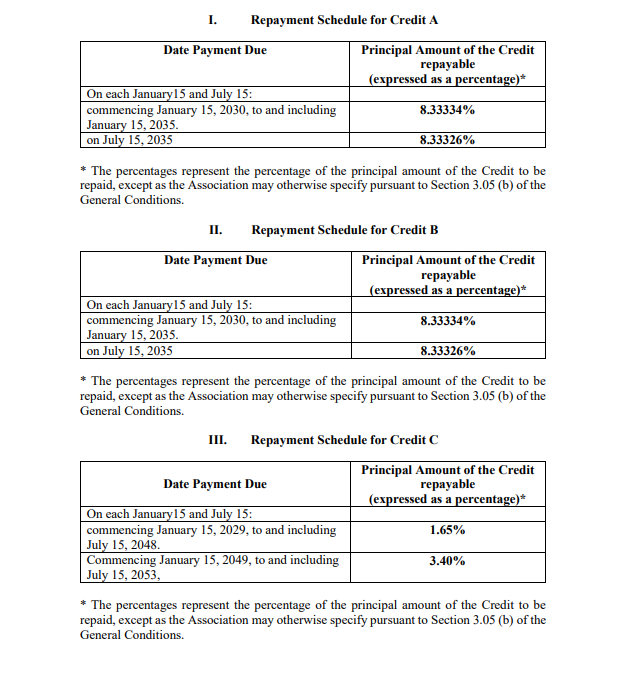

Alongside varying interest rates, the principal payments will be done as follows:

The project’s loan terms are delineated with a Maximum Commitment Charge Rate of 1/2 of 1% per annum on the unwithdrawn financing balance.