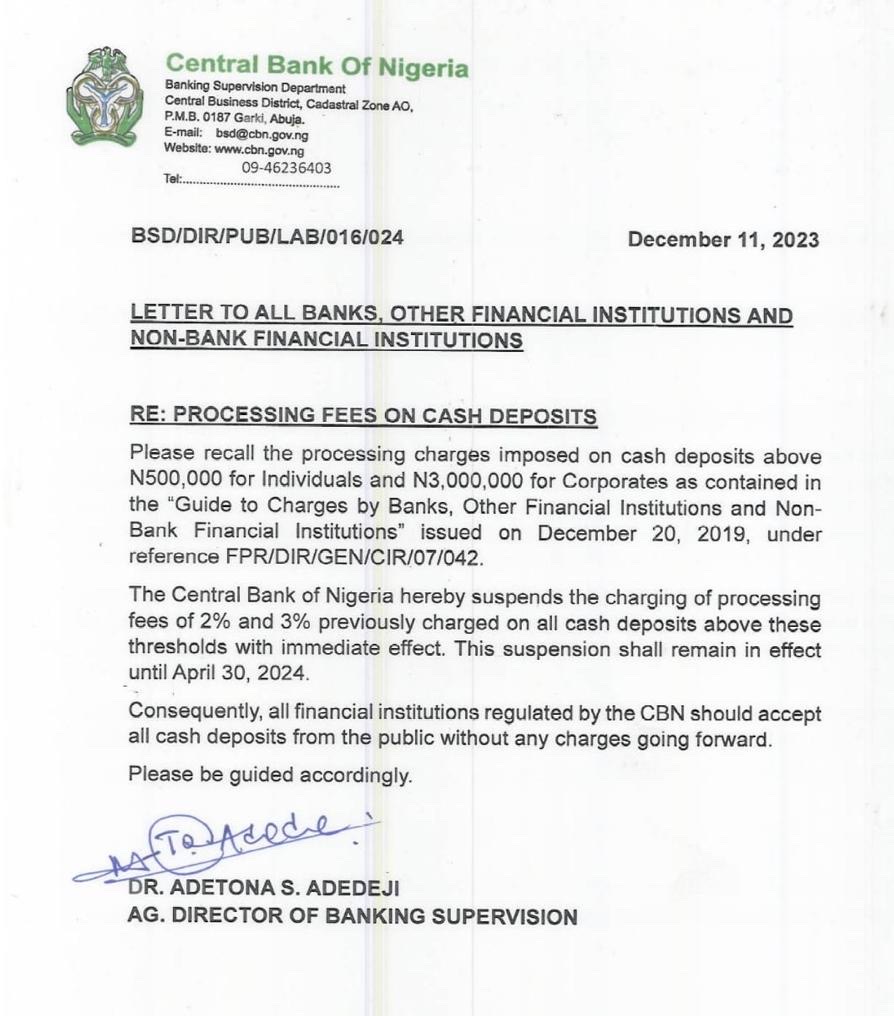

The Central Bank of Nigeria has issued a new directive to all banks, other financial institutions, and non-bank financial institutions, suspending the processing charges previously imposed on large cash deposits.

This change, referenced under the “Guide to Charges by Banks, Other Financial Institutions, and Non-Bank Financial Institutions” dated December 20, 2019 (FPR/DIR/GEN/CIR/07/042), affects deposits over N500,000 for individual accounts and N3,000,000 for corporate accounts.

Previously, these deposits attracted processing fees of 2% and 3%, respectively.

Effective immediately, the CBN has put a hold on these charges.

- This suspension is a significant shift in policy and will remain in effect until the end of April 2024. The move is seen as a response to the evolving financial landscape and the needs of depositors across Nigeria.

- The directive mandates all financial institutions regulated by the CBN to comply by not imposing any charges on cash deposits that meet or exceed these thresholds.

This development is expected to encourage more significant cash deposits, enhance liquidity, and possibly impact various sectors positively, including small and large businesses.

Recall in 2019 the Central Bank of Nigeria (CBN) announced that it would begin to charge bank customers making cash deposits and withdrawals from today, September 19, 2019. In a circular made available to the public, the apex bank disclosed that the new policy of transaction fees was designed to reduce cash in use.

The charges, according to the Central Bank, would attract 3% processing fees for withdrawals and 2% processing fees for lodgments of amounts above N500,000 for individual accounts.

CBN also made known that for corporate accounts, the Deposits Money Banks (DMBs) would charge 5% processing fees for withdrawals and 3% processing fees for lodgments of amounts above N3,000,000.

Also, just over a year ago, the CBN announced a new policy that mandates deposit money banks and other financial institutions to ensure that over-the-counter cash withdrawals by individuals and corporate entities do not exceed N100,000 and N500,000, respectively, per week.

- The revised cash withdrawal limits, contained in a circular issued today by the apex bank and seen by Nairametrics, will take effect nationwide on January 9, 2023.

- After the policy takes effect, all cash withdrawals above the stated limits will attract processing fees of 5% and 10%, respectively.

The new policy came barely weeks after President Muhammadu Buhari launched the newly redesigned N200, N500, and N1000 banknotes. The naira redesign policy has now been cancelled and banks are now expected to accept both the old and new notes.