It’s not as hard as you might think

So you want to be rich but you don’t actually know how to get there, right? Don’t worry, becoming wealthy isn’t as hard as it seems and there are a few simple steps that you can follow that will actually help you reach your financial goals. Here are 7 you should know.

1. Define your financial goals![]()

If you want to get rich you first have to define what that means to you. Do you want to be as wealthy as Elon Musk or are you just looking to retire at around 50 so you can spend your days doing something you love instead of working for somebody else?

Things to think about

Good Financial Cents recommends you think about things like how much you’ll want to save for retirement, should you pay off your debt, and at what point will you invest in the stock market or buy a home as good questions to ask at the start of your wealth journey.

2. Build an emergency fund![]()

Having a cushion of readily available cash is very important for avoiding a vicious cycle of debt that can be incurred when an unexpected financial burden pops into your life. No one ever sees a car accident coming but being able to cover its cost is quite helpful.

How much to save?

Investopedia recommends that you should save at the very least three months’ worth of your current salary for an emergency fund but also said that the amount should reflect your income level and noted six months of expenses might be more helpful for some.

3. Get rid of your remaining debt![]()

If you want to be wealthy then one of the first things you need to do is get rid of all your bad debt, which is different from good debt. Investopedia defined bad debt as “money borrowed to purchase rapidly depreciating assets or assets for consumption.”

Bad debt explained

The goal of eliminating your bad debt is to reduce the amount of money you’re paying in interest on stuff that doesn’t make you money in return. Cars and clothes are two things you shouldn’t go into debt over even if you need them according to Investopedia.

Good debt is an investment![]()

Good debt could include things like your education as well as the funds needed to start a business or purchase your first home. All three of the latter are likely to eventually make you more cash in the long run so going into debt for them is okay, whereas you shouldn’t buy that expensive car.

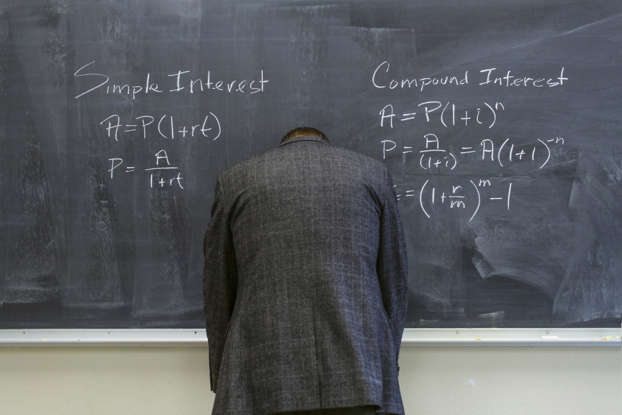

4. Start investing now

If you’ve never heard of compound interest then your life is about to change. Compound interest according to Forbes is when you take the interest earned on your money and reinvest it so that your money can make you even more money in the long run.

What is compound interest?![]()

“Compound interest accelerates the growth of your savings and investments over time,” wrote Forbes Kate Ashford, who pointed out that if you invest $1000 dollars now at 5% when you earn $50 on that investment you can reinvest it at 5% to earn $52.50.

The power of compound interest

“If you left $1,000 in this hypothetical savings account for 30 years, kept earning a 5% annual interest rate the whole time, and never added another penny to the account, you’d end up with a balance of $4,321.94,” Ashford added, so start investing now.

5. Diversify your investments![]()

Don’t put your eggs into one basket is the gist of this piece of financial advice and the reason why you need a diversified portfolio according to Fidelity Investments is so that when one sector takes a hit you don’t take that hit, thereby reducing your overall risk.

A good strategy

Fidelity Investments recommends that investors should primarily look at four components to diversify their portfolios: Domestic stocks, bonds, short-term investments, and stocks from the international market. Speaking to an investment advisor on this can be helpful.

Considering your financial goals![]()

There are many more aspects to investing you could consider, like whether or not you want to include real estate in your investment portfolio. But Fidelity noted you should consider the time horizon of your financial goals before beginning your investing journey.

6. Make more money

This isn’t always easy but finding ways to make more money so you can invest that into your future is one of the fastest ways to get wealthy. “You won’t get rich without multiple flows of income,” self-made millionaire Grant Cordone told CNBC in 2017.

7. Remove limiting beliefs![]()

CNBC also talked to three other self-made millions who gave their advice on how others could get to seven-digit net worth and one of the biggest takeaways was that some people just need to remove the limiting beliefs they have around money and making it.

How the rich got there

“Getting rich begins with the way you think and what you believe about making money,” wrote Steve Siebold in ‘How Rich People Think.’ And he had a lot more to add to that.

Figuring things out![]()

“The rich eventually figure out that training your mind to find solutions to difficult problems is the real secret to making money. The good news is this is possible for anyone who conditions their mind to think this way and then transforms thought into action.” Siebold wrote, which is something you should start doing right now.