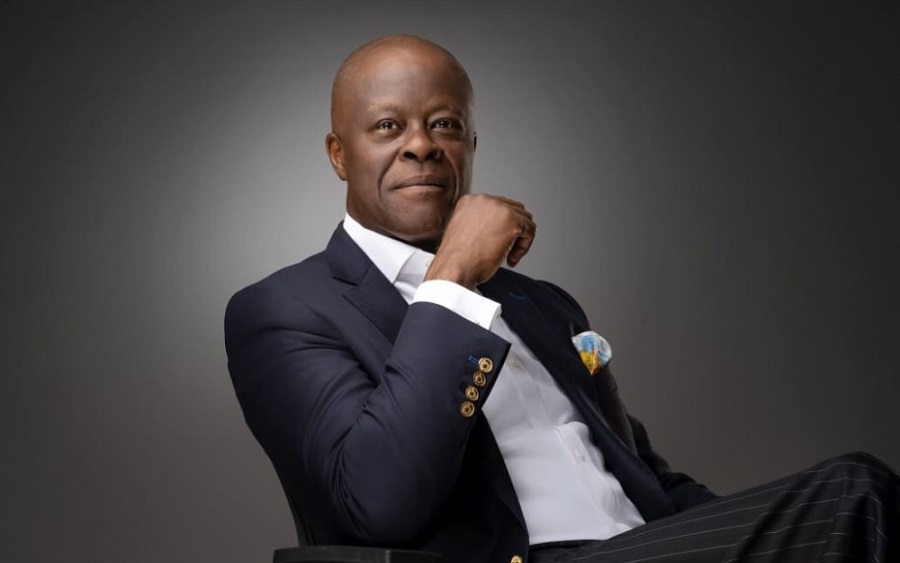

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has confirmed that the federal government plans to raise the Value Added Tax (VAT) to 15%, focusing primarily on luxury goods.

Speaking during an investor meeting at the ongoing IMF/World Bank Annual Meetings in Washington DC, Mr. Edun explained that a bill currently under review by the National Assembly aims to gradually increase VAT on luxury items, while essential goods consumed by vulnerable Nigerians would remain exempt or attract a zero rate.

“In terms of VAT, President Bola Tinubu’s commitment is that while implementing necessary reforms, the poorest and most vulnerable will be protected,” Edun said. “The bills going through the National Assembly will raise VAT for the wealthy on luxury goods while exempting or applying a zero rate to essential items used by the poor and average citizens.”

Mr. Edun added that a list of essential goods exempted from VAT will be released to the public in due time.

The minister also expressed optimism about Nigeria’s oil sector, citing improved security in oil-producing regions and fresh investments from companies like Total and ExxonMobil. He noted that these developments would boost oil production and enhance foreign exchange inflows.

Addressing the removal of fuel subsidies, Edun revealed that while subsidy reforms were announced earlier, full implementation only took effect last month. He emphasized that the savings from subsidy removal would have a more noticeable impact on the economy in the coming months.

Responding to queries about Nigeria’s financial strategy, Mr. Edun disclosed that the government proceeded with issuing domestic dollar bonds despite advice from the International Monetary Fund (IMF) against such a move. He affirmed that while Nigeria maintains a cooperative relationship with the IMF, it retains autonomy over its financial decisions.