Nigeria has received the first tranche of the US$2.5 billion facility, arranged by the African Export-Import Bank (Afrexim Bank), with the United Bank for Africa (UBA) serving as the local facilitator.

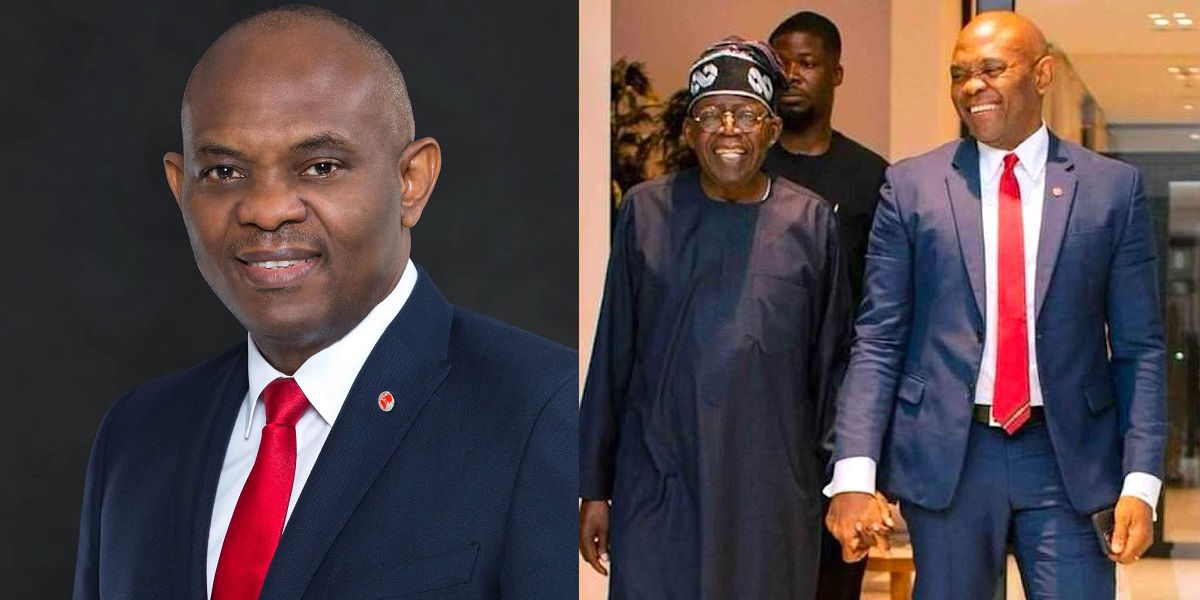

UBA, a prominent member of the FUGAZ group, has been designated as the mandated local arranger for this significant US$2.5 billion liquidity support facility for Nigeria.

Afrexim Bank, playing a critical role in this financial endeavour, is the Mandated Lead facilitator for the structured finance facility.

The Deal

This pivotal agreement was officially signed on December 29, 2023, marking a milestone in the financial cooperation between the involved entities, who also recently signed a $150 million deal.

- In this strategic financial arrangement, Afrexim Bank, fulfilling its role as the Mandated Lead Arranger, works in close coordination with the United Bank for Africa, which assumes the responsibility as the Local Arranger.

- The facility was successfully finalized with NNPC Limited acting as the principal financier.

The arrangement also includes Guvnor and Sahara Energy as key participants in the transaction, highlighting the collaborative effort of multiple stakeholders.

- The total transaction value is US$3.3 billion, which will be loaned to Nigeria as liquidity support to help alleviate its foreign exchange (forex) challenges.

- The first tranche of the transaction amounts to US$2.25 billion. This sum will be deposited into a designated account at the Central Bank, and it is expected to ease forex liquidity pressures.

- United Bank for Africa (UBA) will serve as the Local Arranger, while the African Export-Import Bank (Afrexim Bank) is the Mandated Lead Arranger for the transaction.

- UBA is also functioning as the Onshore Depository Bank for this arrangement.

- The Nigerian National Petroleum Corporation (NNPC) is facilitating the financing of this transaction, acting as a lender. Other major oil trading firms involved as sub-lenders include Sahara Energy, Vitol, Oando, and Guvnor.

- In addition to their roles in the transaction, UBA, Sahara Energy, Vitol, Oando, and Guvnor have each contributed $100 million to the facility.

Sources learnt that the remaining balance of the facility, amounting to US$1.05 billion, is scheduled to be disbursed in January 2024.

In addition to this, we understand that there are other developments aimed at liquefying the foreign exchange (FX) market. These are being spearheaded by leading domestic and Africa-focused entities, which are actively developing solutions to address economic issues in Nigeria.

It previously reported that Afrexim Bank was in talks with oil traders to secure financing for a $3 billion commitment it pledged to the Nigerian National Petroleum Company Limited (NNPCL).

- AfreximBank initiated discussions with various traders to explore their interest in providing necessary funding through an oil-backed loan for the NNPCL.

- On August 16, 2023, the Nigerian National Petroleum Company Limited (NNPCL) and AfreximBank made a joint announcement from Cairo, Egypt.

- Both entities officially signed a commitment letter and Termsheet for an urgent $3 billion loan. This loan is designated specifically for the repayment of crude oil.

- The primary aim of this loan is to empower NNPC Limited to play a crucial role in supporting the Federal Government’s ongoing fiscal and monetary policy reforms.