Tata Motors has slowed down its search for a partner in the passenger vehicle segment and is, instead, looking to chart a new plan on its own, buoyed by a turnaround in the business, a senior executive said.

Sustained volume momentum and structured cost-cutting exercise has put the car division in a self-sustaining mode, Shailesh Chandra, president of Passenger Vehicle (PV) business at Tata Motors, said.

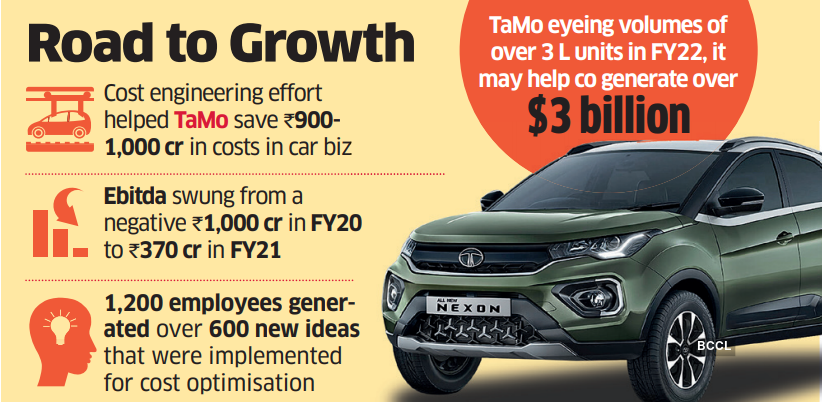

The maker of Tiago hatchback and Nexon compact SUV is set to cross 10% market share and report Ebitda of $100-125 million (Rs 750-1,000 crore) in the current fiscal, experts said.

Chandra claimed that the firm’s ‘GEAR’ initiative – generate, evaluate, approve and realise – will help it cut costs on an annual basis. “An institutionalised method to provide 5-7% cost reduction every year and new products will help us grow our business,” he said.

He declined to disclose after how many years had the PV business become Ebitda positive.

Tata Motors had earlier this year got its shareholders’ approval to hive off the PV business into a separate entity.

About 1,200 employees were involved in the cost-saving exercise, and more than 600 new ideas were implemented for cost optimisation after conducting over 1,000 workshops, Chandra said.

This helped the company absorb soaring raw material prices, and it passed on only half of raw material price increase to the end consumers, he said. Tata Motors has raised car prices only once in 2021 so far and may soon implement another increase soon versus thrice by market leader Maruti Suzuki so far.

Tata Motors is forecasting volumes of over 300,000 units to the vendors for FY-22.

According to ETIG analysis, the company may deliver a turnover of $3 billion.

It is now on the cusp of achieving a 10% share of the PV market in the country, up from 4.3% in FY20.

In FY21, despite the pandemic, Tata Motors posted a sales volume growth of 69% against an overall decline of 2% in the industry, reclaiming its position as the third-largest PV maker after nine years.

Cost savings were effected through steps both at the commercial and operational sides, Chandra said. On the commercial side, the company renegotiated prices with suppliers by various means – striking better bargains and reducing the weight of the components to save materials costs for the suppliers.

On the operations side, the company focused on optimising energy costs, productivity improvement, efficiency improvement, and optimisation of logistics costs.

Absolute operating profit of the car division was the highest in the last ten years and the company posted a 4.9% operating margin in the last quarter of FY21 as revenues grew 144% to Rs 6,600 crore, the highest in the eight years.

The PV division delivered positive Ebitda for three quarters in a row. Compared to the peers, the annual revenue of the Tata Motors PV division rose to 24% of Maruti Suzuki in FY21 compared with 14% a year ago.

Interestingly, the average realisation of Tata Motors is Rs 7.58 lakh per unit, which is superior to Maruti Suzuki’s Rs 4.56 lakh.

The company has been still incurring losses before tax due to depreciation and interest expenses.

The EBIT loss of the PV was Rs 1,567 crore in FY21 compared with Rs 2,713 crore in FY20. According to analyst estimates, the PV division could turn PBT positive if sales volume crosses 370,000 units and Ebitda margin remains around 7-8%. The company has guided for high single-digit Ebitda in the next three years and free cash flow breakeven by FY23.